1. A coal mine receives two bids for purchase of a new dragline. The first bid quotes Rs. 150 crore as a price to be paid in full on delivery. The second bid quotes Rs. 180 crore as a price payable at the end of the third year after delivery. If the discount rate is 12%, the difference in NPV between the first and second bids in crore of rupees is

2. A person borrows a sum of Rs. 50,000 @ 6% interest rate for 10 years. Determine the equal annual sum to be paid at the end of each year to repay the loan.

3. The probability distribution of the outcome of an investment is

Outcome (Rs.)

1000

700

300

Probability

0.2

0.5

0.3

The expected rate of return is

| Outcome (Rs.) | 1000 | 700 | 300 |

| Probability | 0.2 | 0.5 | 0.3 |

The expected rate of return is

4. Hoskold's formula is used for

5. At a discount rate of 12%, uniform annual savings producing Rs. 6 lakhs at the end of 10 years is

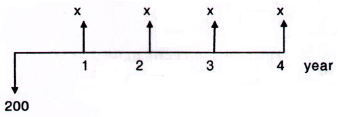

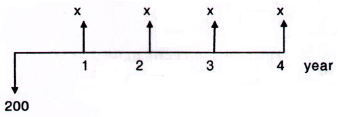

6. A cash flow diagram is shown below. Based on NPV, at 10% rate of interest, the minimum annuity x at which the investment becomes viable is

7. The cash flow of a project is given as follows:

Year

0

1

2

3

4

Cash flow (Rs.)

-5000

15000

15000

20000

22500

The internal rate of return (IRR) in percent lies between

| Year | 0 | 1 | 2 | 3 | 4 |

| Cash flow (Rs.) | -5000 | 15000 | 15000 | 20000 | 22500 |

The internal rate of return (IRR) in percent lies between

8. Using Hoskold's formula, the present worth, in rupees of annuity of Rs. 1 per year for the 10 years after the deferment period of 5 years and allowing the purchaser 10 % interest is

9. An equipment cost Rs. 8,00,000 today and has a service life of 15 years. The salvage value at the end of 15 years is Rs. 2,00,000. What will be the value at the end of 10 years?

10. The probability distribution of the outcome of an investment is

Outcome (Rs.)

1000

700

300

Probability

0.2

0.5

0.3

The measure of risk of the investment based on standard deviation (?) is given as

| Outcome (Rs.) | 1000 | 700 | 300 |

| Probability | 0.2 | 0.5 | 0.3 |

The measure of risk of the investment based on standard deviation (?) is given as